43 bond coupon interest rate

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) a coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and … Question on Bond Prices and Coupon Rates : CanadianInvestor Bond A has a coupon rate of 9.00%. Bond B has a coupon rate of 5.00%. Say market interest rates rise from 1% to 2%. The prices of both bonds will go down. Given that the coupon rates are different, My question is: Are both bonds equally affected?

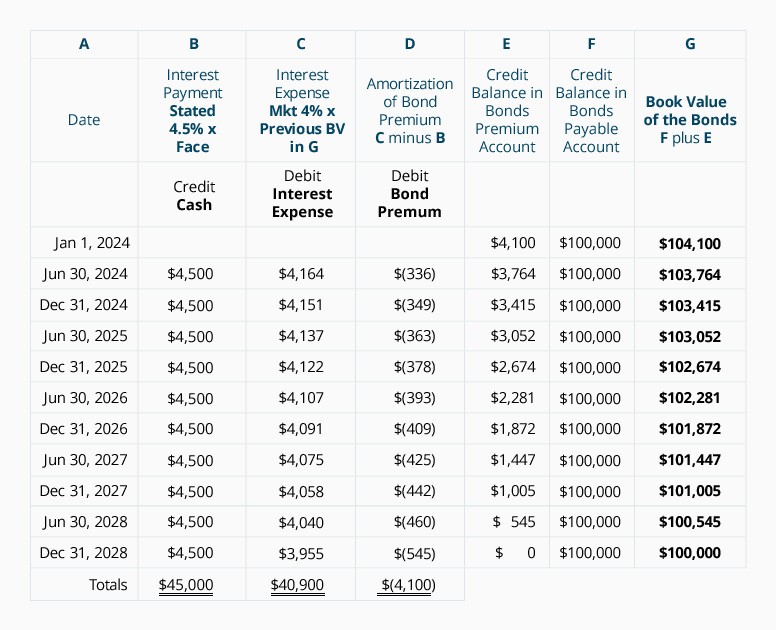

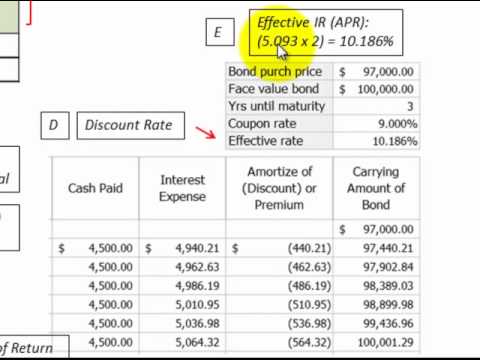

How to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers.

Bond coupon interest rate

What Is Coupon Rate and How Do You Calculate It? The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate on its coupon. Investors use the phrase coupon rate for two reasons. Coupon Rate Formula | Step by Step Calculation (with Examples) Dave said that the coupon rate is 10.00% Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct. What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Bond coupon interest rate. Here's how rising interest rates may affect your bond portfolio Interest rates are rising in 2022 — here are your best money moves. For example, let's say you have a 10-year $1,000 bond paying a 3% coupon. If market interest rates rise to 4% in one year ... Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. What is Coupon Rate? Definition of ... - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals $20. Whether the economy improves, worsens, or remains the same, the interest income does not change. Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%).

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. B10. A 2-year zero-coupon bond has an interest rate | Chegg.com A 2-year zero-coupon bond has an interest rate of 5% (ro,2 = 0.05). The price of this bond is denoted P²). Investors expect that 1-year interest rate in two years will be 4% (E[r2,3] = 0.04). In questions B10a - B10d Assume that that the expectations theory of term structure holds. B10a. What should be the price, P³), of a 3-year zero coupon ... Coupon Rate Calculator | Bond Coupon coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)? How the Fed's rate increase may affect your bond portfolio Bond investors are watching as the Federal Reserve raises interest rates for the first time since 2018 to combat surging prices. Annual inflation rose by 7.9% in February, a new 40-year high ...

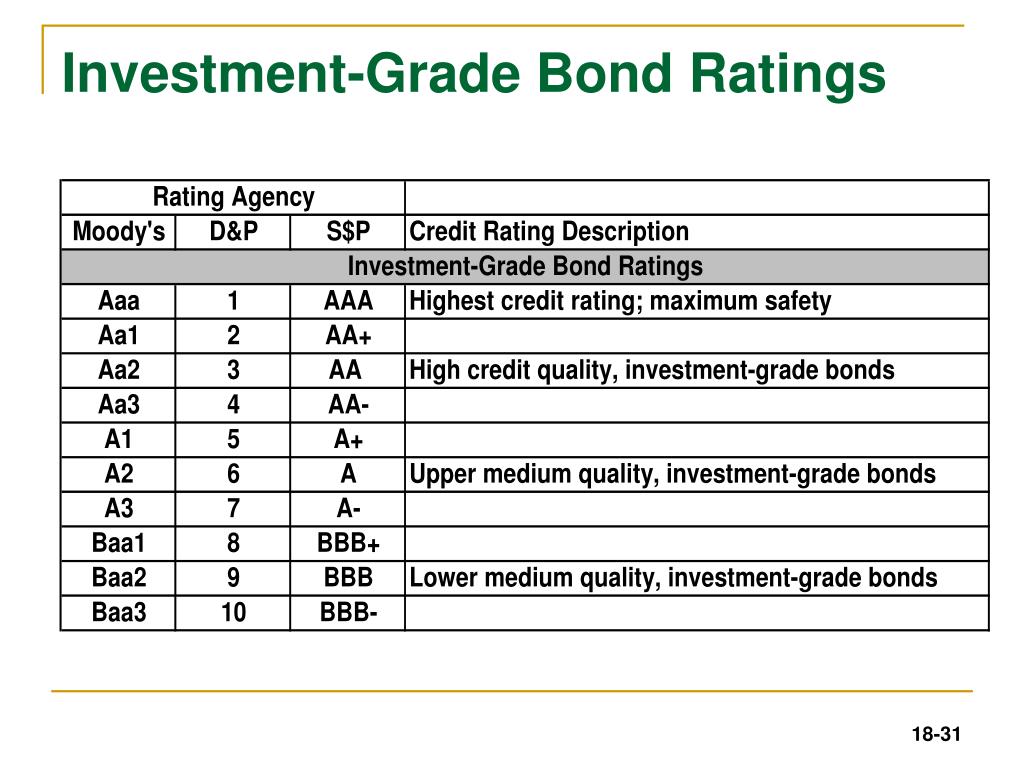

Individual - Treasury Bonds: Rates & Terms The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) The price of a fixed rate security depends on its yield to maturity and the interest rate. Relationship Between Interest Rates & Bond Prices EssentialsTechnical AnalysisRisk ManagementMarketsNewsCompany NewsMarkets NewsTrading NewsPolitical NewsTrendsPopular StocksApple AAPL Tesla TSLA Amazon AMZN AMD AMD Facebook Netflix NFLX SimulatorYour MoneyPersonal FinanceWealth ManagementBudgeting SavingBankingCredit CardsHome OwnershipRetirement PlanningTaxesInsuranceReviews RatingsBest Online BrokersBest Savings AccountsBest Home ... Coupon Rate Definition - Investopedia The coupon rate is the annual income an investor can expect to receive while holding a particular bond. It is fixed when the bond is issued and is calculated by ...5 Sept 2021 · Uploaded by James ChenHow Are Coupon Rates Affected by Market Interest Rates?What's the Difference Between Coupon Rate and YTM? Key Characteristics of Bonds | Boundless Finance | | Course Hero The coupon rate is the amount of interest that the bondholder will receive expressed as a percentage of the par value. Thus, if a bond has a par value of 1,000 and a coupon rate of 10,100 a year during the time between when the bond is issued and when it matures.

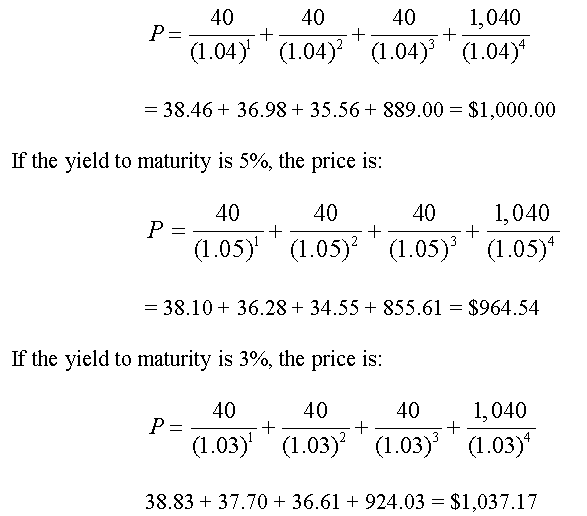

Bond Pricing - Formula, How to Calculate a Bond's Price A bond could be sold at a higher price if the intended yield (market interest rate) is lower than the coupon rate. This is because the bondholder will receive coupon payments that are higher than the market interest rate, and will, therefore, pay a premium for the difference.

Basics Of Bonds - Maturity, Coupons And Yield Coupon yield is the annual interest rate established when the bond is issued. It's the same as the coupon rate and is the amount of income you collect on a bond, expressed as a percentage of your original investment. If you buy a bond for $1,000 and receive $45 in annual interest payments, your coupon yield is 4.5 percent.

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50.

Series I Savings Bonds Rates & Terms: Calculating Interest Rates The composite rate for I bonds issued from May 2022 through October 2022 is 9.62 percent. This rate applies for the first six months you own the bond. How do I bonds earn interest? An I bond earns interest monthly from the first day of the month in the issue date.

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? 5*2 = $781.20. The price that John will pay for the bond today is $781.20. Reinvestment Risk and Interest Rate Risk

Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Coupon Interest and Yield for eTBs - australiangovernmentbonds What is the Coupon Interest Rate? The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months.

Post a Comment for "43 bond coupon interest rate"