44 coupon rate vs ytm

Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. 1 It is the sum of all of its remaining coupon payments.... What is a Coupon Rate? | Bond Investing | Investment U For long-term investors, coupon rate is a more important factor than YTM. This is because they're more likely to depend on the interest payouts of the bond. Therefore, a higher coupon means a higher payment. Conversely, bond traders prefer YTM because they're acquiring bonds in a secondary market, where carrying value matters more.

Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube We also explain the difference between the face value and the market value of the bond and their relationship to the coupon rate, current yield, and yield to maturity (YTM). We go through examples...

Coupon rate vs ytm

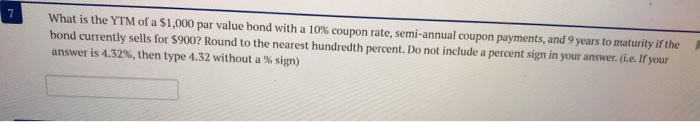

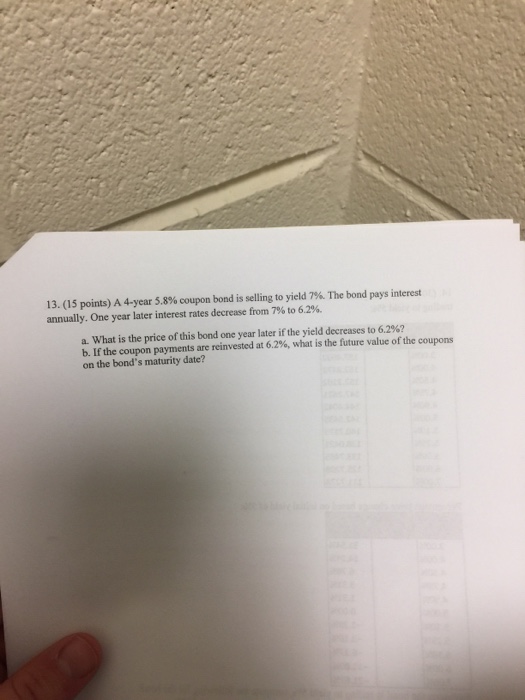

Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : Help us improve. Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion Difference Between Coupon Rate and Yield to Maturity (With Table) The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

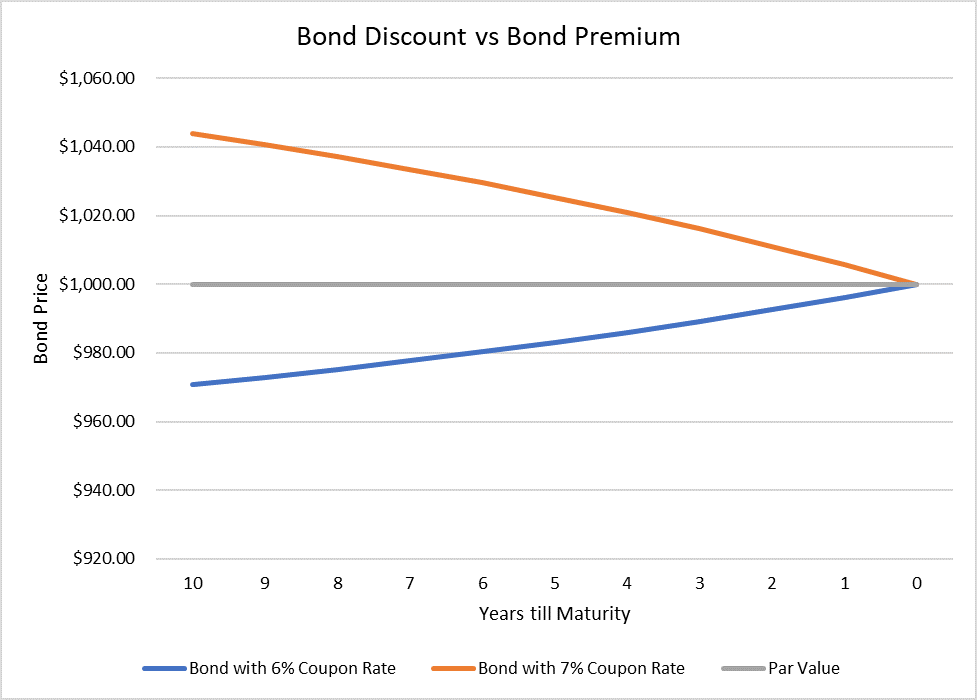

Coupon rate vs ytm. Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Coupon vs Yield | Top 8 Useful Differences (with Infographics) The coupon rate of a bond is the amount of interest that is actually paid on the principal amount of the bond (at par). While yield to maturity defines that it's an investment that is held till the maturity date and the rate of return it will generate at the maturity date. Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity What's the difference b/w coupon rate and YTM? And why do we ... - reddit In this example, since the ytm is less than the coupon rate, the bond must be trading at a premium to its face value. Let's say with a FV of 100, you end up paying 102. Now 5.8% will be the discount rate used to bring back the $6 annual coupon payments and $100 principal repayment back to the present value. Coupon rate is exactly what it says.

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security. Yield to Maturity vs Coupon Rate: What's the Difference If you purchase the bond at face value, the YTM and the coupon rate are the same. Otherwise, the YTM increases or decreases depending on whether you've purchased a discount or premium bond. Compare the Yield to Maturity vs Coupon Rate Before Purchasing Bond. Investing your money is not an action you should take lightly. Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the estimated annual rate of return for a bond assuming that the investor holds the asset until its maturity date. The coupon rate is the earnings an investor can expect to receive from holding a particular bond. To complicate things the coupon rate is also known as the yield from the fixed-income product ... Coupon vs Yield | Top 5 Differences (with Infographics) The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond.

Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3 EOF Yield to maturity - Wikipedia Coupon rate vs. YTM and parity. If a bond's coupon rate is less than its YTM, then the bond is selling at a discount. ... Formula for yield to maturity for zero-coupon bonds = Example 1. Consider a 30-year zero-coupon bond with a face ... Difference Between Coupon Rate and Yield to Maturity (With Table) The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : Help us improve.

Post a Comment for "44 coupon rate vs ytm"