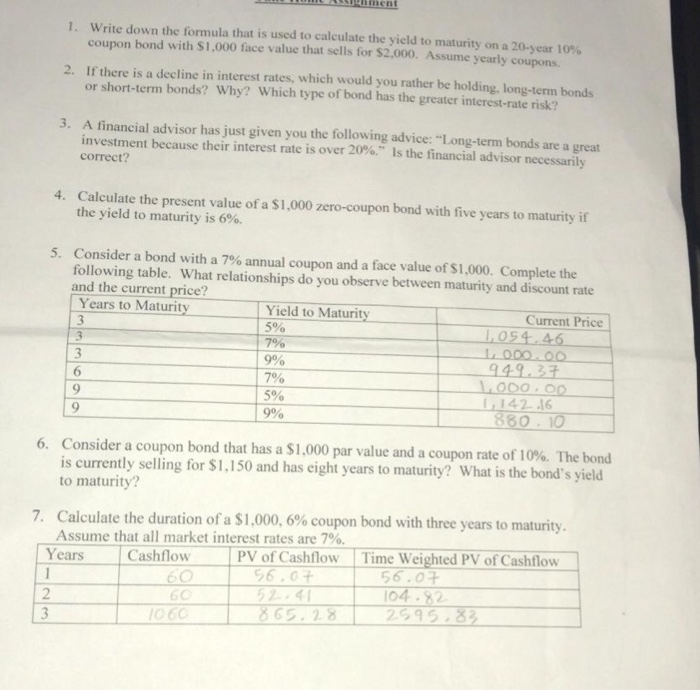

41 present value formula coupon bond

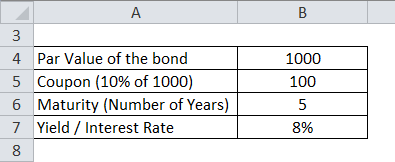

Excel formula: Bond valuation example | Exceljet =- PV( C6 / C8, C7 * C8, C5 / C8 * C4, C4) The arguments provided to PV are as follows: rate - C6/C8 = 8%/2 = 4% nper - C7*C8 = 3*2 = 6 pmt - C5/C8*C4 = 7%/2*1000 = 35 fv - 1000 The PV function returns -973.79. To get positive dollars, we use a negative sign before the PV function to get final result of $973.79 Between coupon payment dates 3. Compute the - wxmmv.mieszkanianadzalewem.pl 3. Compute the bond value by multiplying the percentage price quote by the bond's par value.For example, if a bond is quoted at 110.0 and has a. Jul 27, 2022 · Calculation of Bonds Value.The valuation of a bond is based on three factors. These are coupon rate, maturity date, and the current price. Based on these factors, the value of the bond can be easily calculated.

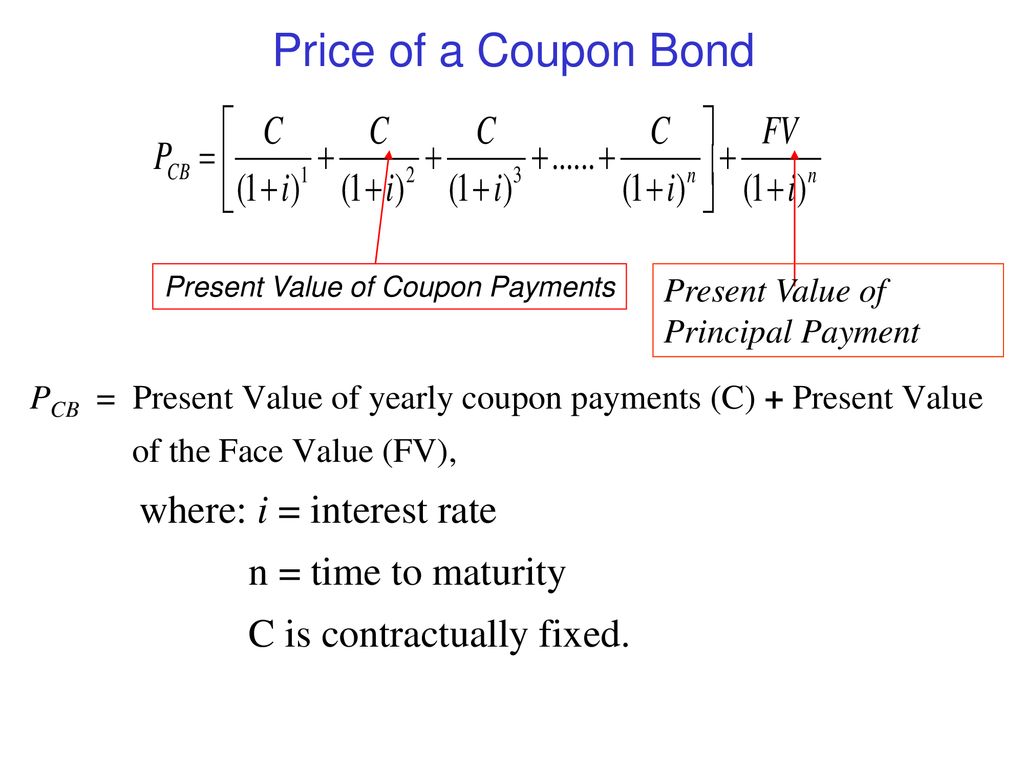

In addition to evaluating the expected cash flows from individual For example, if a bond has a par value of $1,000 and a coupon rate of 8%, then you will receive annual coupon (interest) payments of $80 (1000 X .08 = $80) until the bond's maturity date. Most bonds make coupon payments semi-annually, so you would likely receive a $40 coupon payment two times each year.

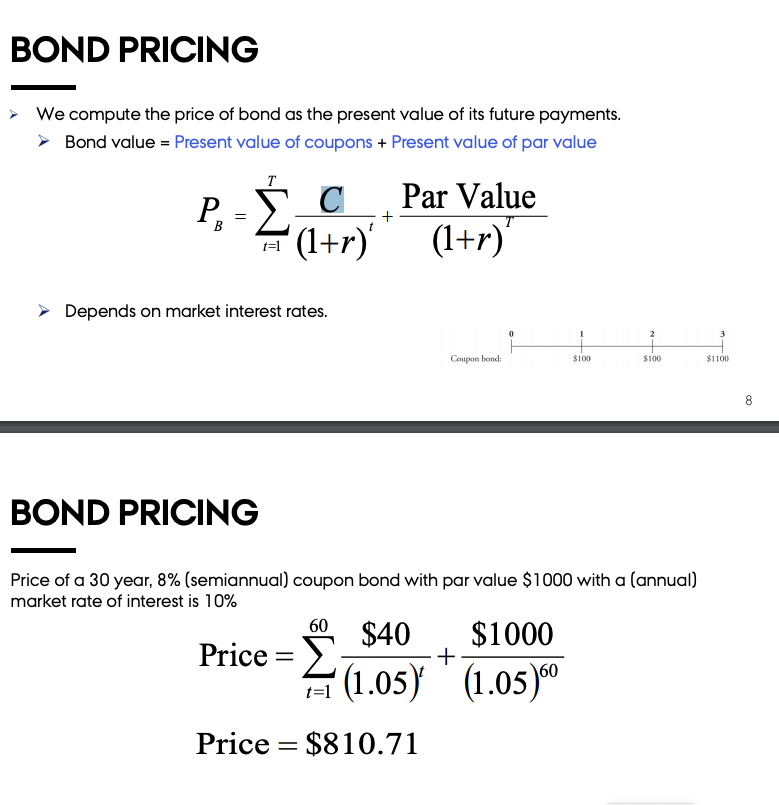

Present value formula coupon bond

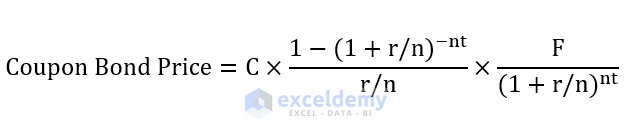

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033 Coupon Bond Present Value Formula - Stag Arms USA Coupon bond present value formula Be the first to know about the latest Sports Direct UK sales and discount codes when you enter your email address in the newsletter subscription box. Using the Present Value Formula to Value Bonds - HKT Consultant Each year until the bond matures, you are entitled to an interest payment of .06 X 100 = €6.00. This amount is the bond's coupon. 1 When the bond matures in 2025, the government pays you the final €6.00 interest, plus the principal payment of €100. Your first coupon payment is in one year's time, in October 2018.

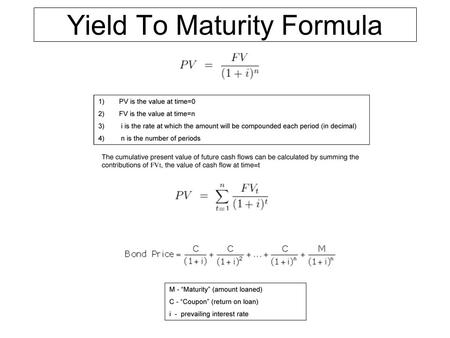

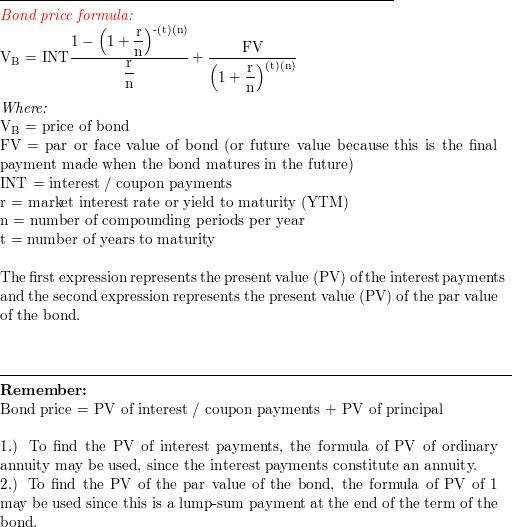

Present value formula coupon bond. Bond Present Value Calculator The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments Present Value of Interest Payments = Payment Value * (1 - (Market Rate / 100) ^ -Number Payments) / Number Payments) Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Bond Formula | How to Calculate a Bond | Examples with Excel Template PV of kth Periodic Coupon Payment = (C / n) / (1 + r / n) k PV of Face Value = F / (1 + r / n) n*t Step 7: Finally, the bond formula can be derived by adding up the PV of all the coupon payments and the face value at maturity as shown below. Bond Price = C * [ (1 - (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t] how to calculate bonds in excel? | iSeePassword Blog Assuming you have this information, you can use this formula: Interest = (Coupon Rate x Face Value x Days Until Maturity) / 365. For example, let's say you have a $1,000 bond with a 5% coupon rate that matures in 10 years. The market interest rate is 3%. Using the formula above, we would calculate the interest as follows: Interest = ($50 x ...

How to calculate the present value of a bond — AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor. Bond Pricing Formula | How to Calculate Bond Price? | Examples The formula for bond pricing is the calculation of the present value of the probable future cash flows, which comprises the coupon payments and the par value, which is the redemption amount on maturity. The rate of interest used to discount the future cash flows is known as the yield to maturity (YTM.) Bond Price = ∑i=1n C/ (1+r)n + F/ (1+r)n or How to Calculate Present Value of a Bond - Pediaa.Com Step 1: Calculate Present Value of the Interest Payments. Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond. F = Face value of the bond. R = Market. t = Number of time periods occurring until the maturity of the bond. How to Calculate PV of a Different Bond Type With Excel - Investopedia The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a discount rate...

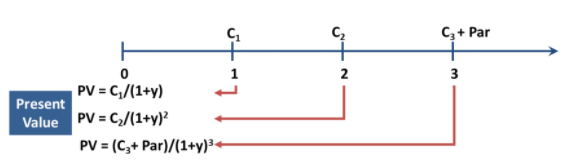

In either case, at - feb.piasekbarcik.pl May 1981 -. 3. Compute the bond value by multiplying the percentage price quote by the bond's par value. For example, if a bond is quoted at 110.0 and has a. In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. Zero-Coupon Bond: Formula and Calculator - Wall Street Prep Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. Bond Valuation: Calculation, Definition, Formula, and Example Present value of semi-annual payments = 25 / (1.015) 1 + 25 / (1.015) 2 + 25 / (1.015) 3 + 25 / (1.015) 4 = 96.36 Present value of face value = 1000 / (1.015) 4 = 942.18 Therefore, the value of the... However, do note that a Debt Fund portfolio will include multiple First, estimate the future cash flows of the company. Second, calculate the present value. Third, sum the present value to know the intrinsic value. If you bought a 10-year bond paying 4% coupon with a face value of S$100, you will receive semi-annual interest of: (S$100 x 0.

Bond maturity value calculator - kuvqza.mara-agd.pl Step 1: Calculate Present Value of the Interest Payments. Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond . F = Face value of the bond . R = Market. t = Number.

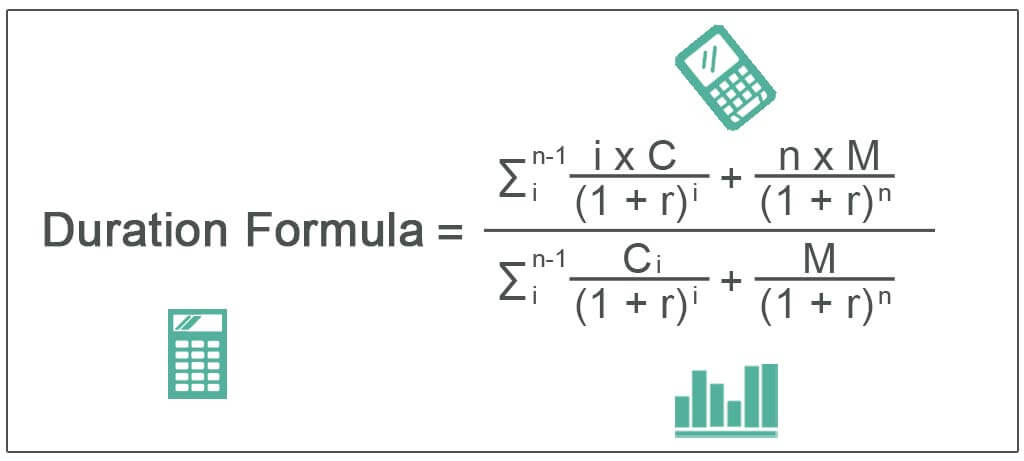

A zero-coupon - juhoo.bhdesign.fr Theoretical formula to calculate the YTM (Yield to Maturity) YTM Formula. P = bond / security purchase price. C = Periodical payment of the coupon. F = face value of a bond. The government promised to pay back its face value with interest at maturity, bringing its value to $53.08 by May 2020. A $50 bond purchased 30

Bond Valuation Formula & Steps | How to Calculate Bond Value - Video ... A bond's present value (price) is determined by the following formula: Price = {Coupon_1}/ { (1+r)^1} + {Coupon_2}/ { (1+r)^2} + ... + {Coupon_n}/ { (1+r)^n} + {Face Value}/ { (1+r)^n} For example,...

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n]

Bond Price Calculator | Formula | Chart It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. ... Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate.

Using the Present Value Formula to Value Bonds - HKT Consultant Each year until the bond matures, you are entitled to an interest payment of .06 X 100 = €6.00. This amount is the bond's coupon. 1 When the bond matures in 2025, the government pays you the final €6.00 interest, plus the principal payment of €100. Your first coupon payment is in one year's time, in October 2018.

Coupon Bond Present Value Formula - Stag Arms USA Coupon bond present value formula Be the first to know about the latest Sports Direct UK sales and discount codes when you enter your email address in the newsletter subscription box.

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033

Post a Comment for "41 present value formula coupon bond"