42 coupon rate for treasury bonds

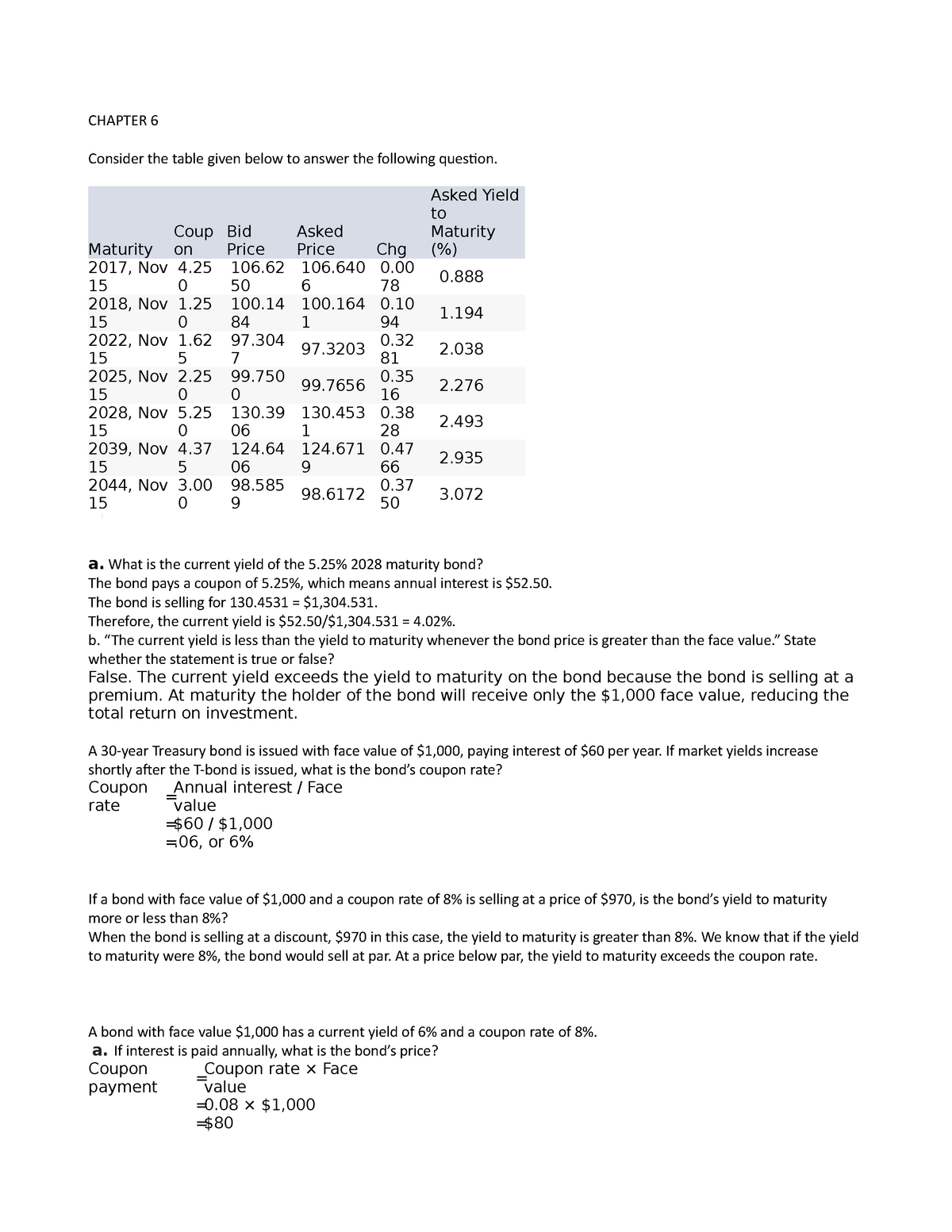

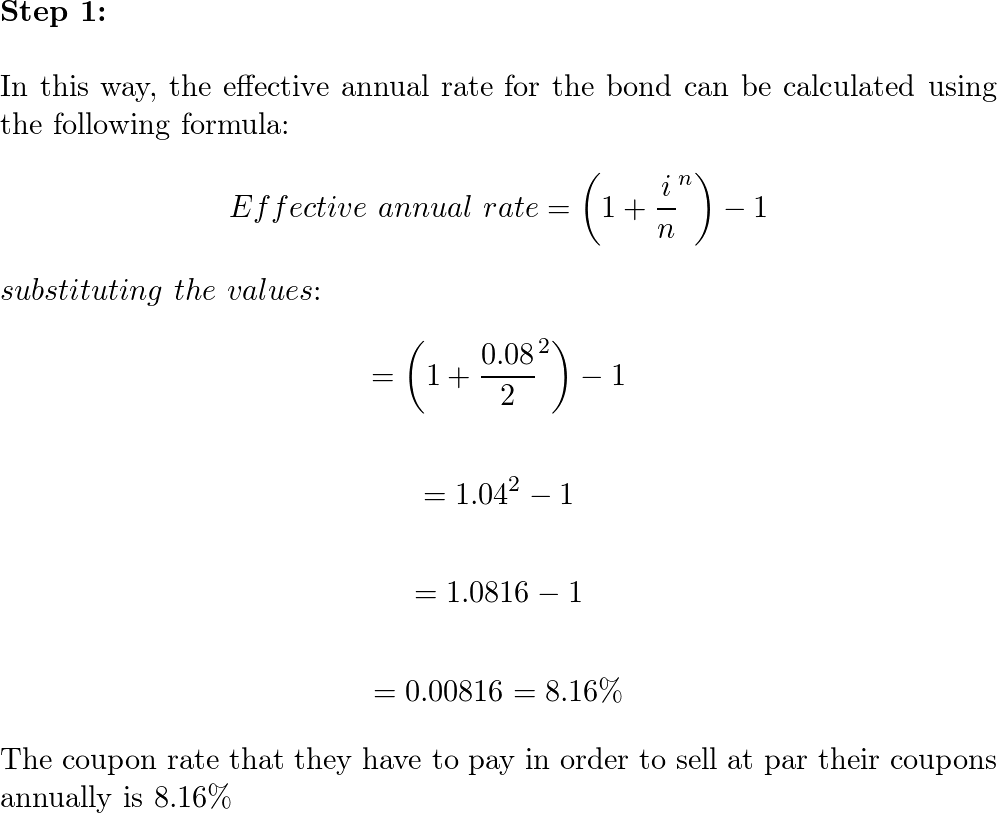

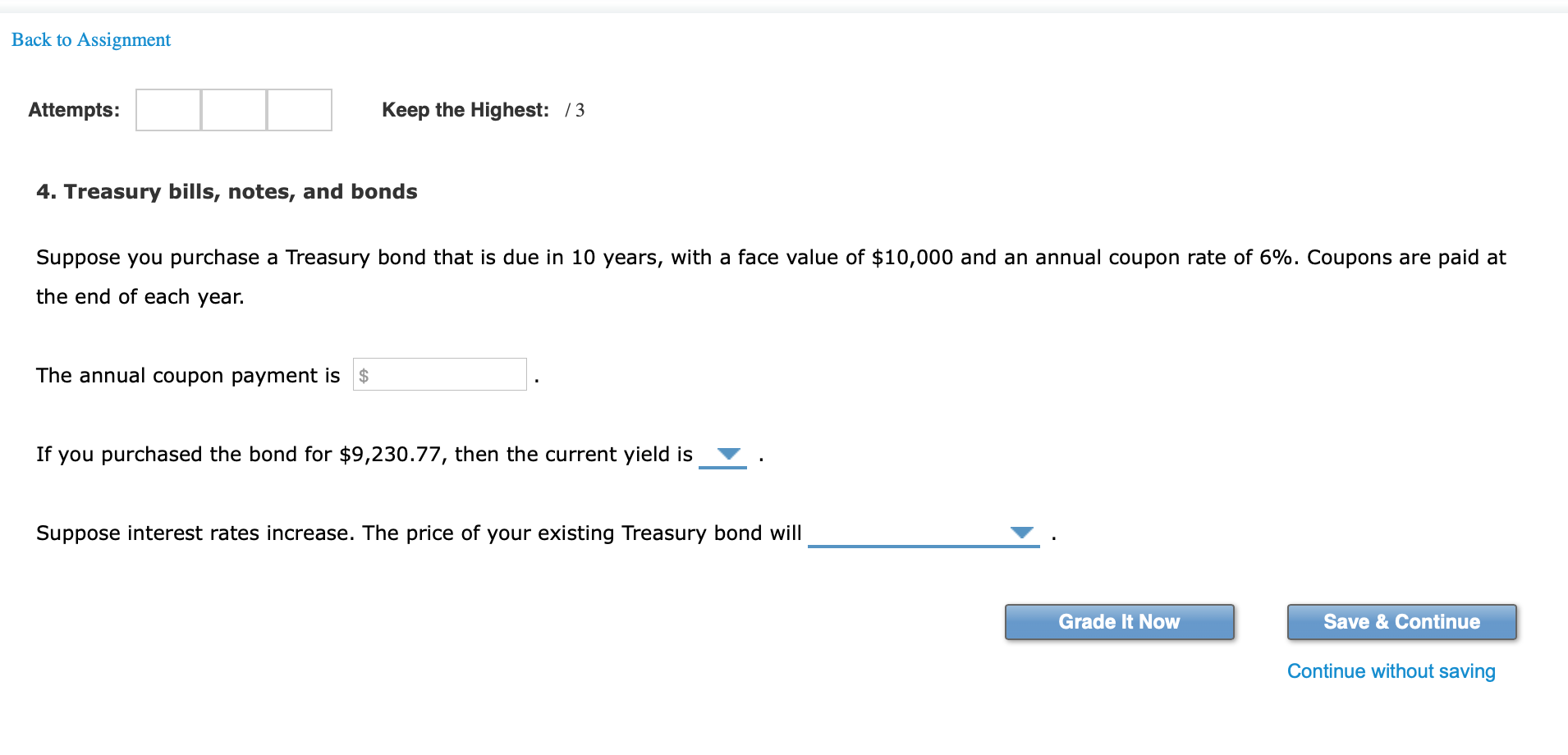

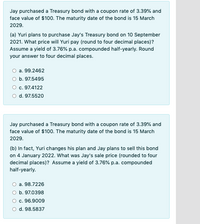

Understanding Coupon Rate and Yield to Maturity of Bonds In the above example, a Retail Treasury Bond (RTB) pays coupons quarterly. To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Coupon Rate Calculator | Bond Coupon coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)?

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Coupon rate for treasury bonds

Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The... Coupon (finance) - Wikipedia Zero-coupon bonds are those that pay no coupons and thus have a coupon rate of 0%. Such bonds make only one payment: the payment of the face value on the maturity date. Normally, to compensate the bondholder for the time value of money, the price of a zero-coupon bond will always be less than its face value on any date U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate - Forbes With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is an ...

Coupon rate for treasury bonds. Treasury Bonds | CBK Jul 25, 2022 · Find your bond’s coupon rate, maturity date and issue date using our Treasury Bonds Results table above. You’ll find a full schedule of your bond’s interest payments in its prospectus, which you can search for in our Treasury Bonds Prospectuses table above. Kindly note that this calculator uses a coupon-based rediscounting rate. Coupon Rate Formula | Step by Step Calculation (with Examples) In other words, it is the stated rate of interest paid on fixed-income securities, primarily applicable to bonds. The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Treasury Yields. Name Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month . How does the U.S. Treasury decide what coupon rate to offer on Treasury ... The Treasury picks the coupon to the nearest 1/8th that prices the bond closest to par. E.g. if the implied 10yr Trsy yield is 2.03% when the auction happens, the Treasury would set the coupon as 2%. Simple as that. If the coupon were set to 6%, the bond would trade at a huge premium.

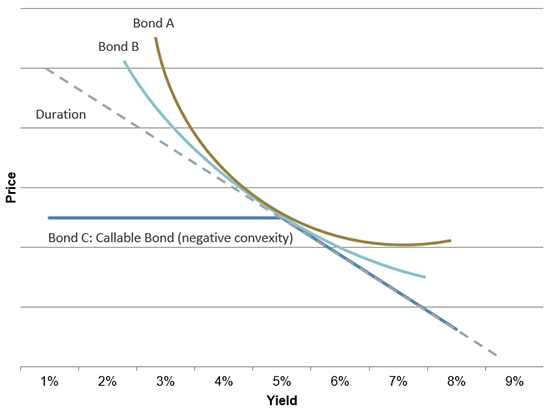

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S.... Coupon Interest and Yield for eTBs | australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. United States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes.. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals $20. Whether the economy improves, worsens, or remains the same, the interest income does not change. Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%).

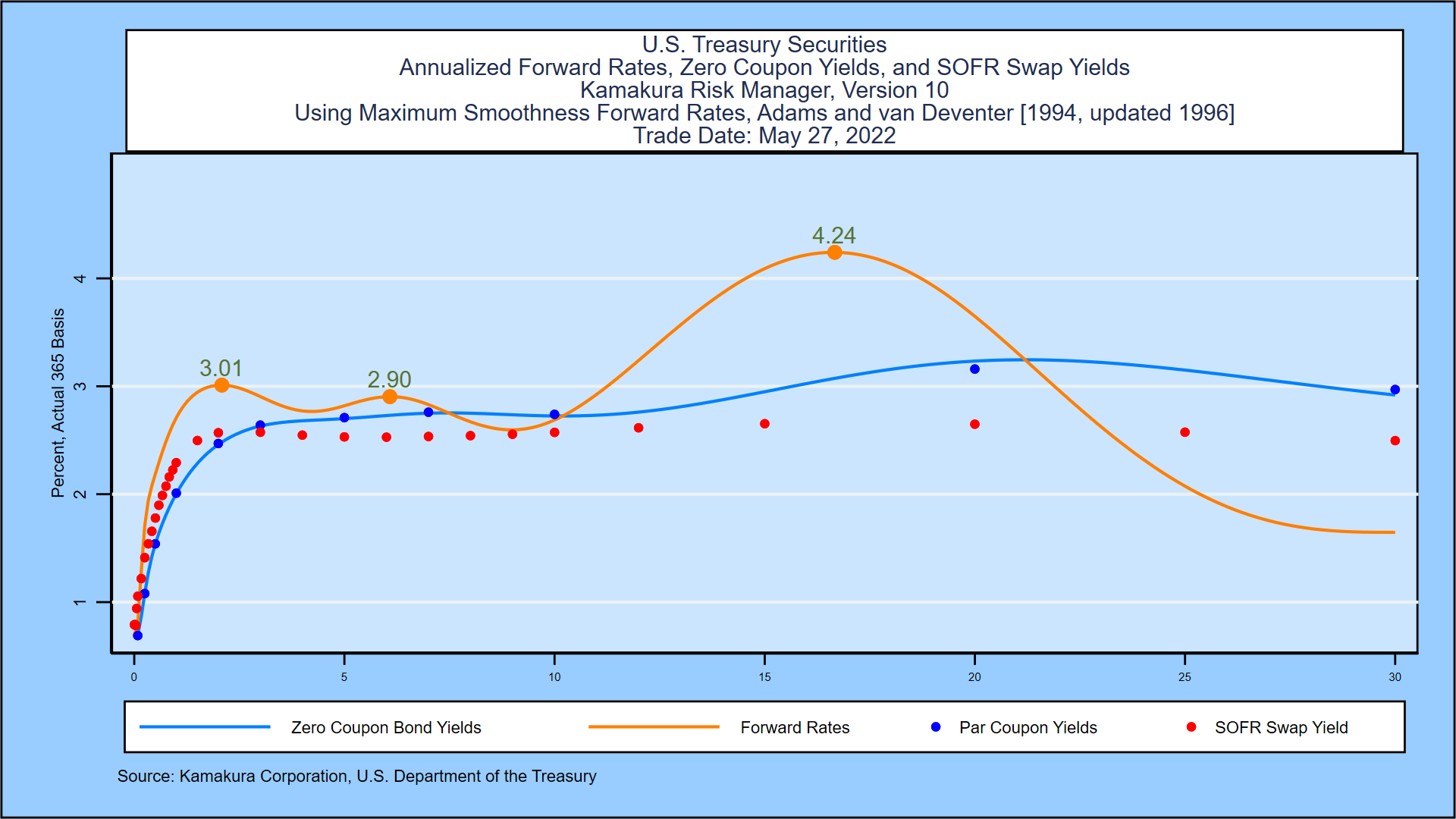

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. How Often do Treasury Bonds Pay Interest? | Fox Business A 30-year U.S. Treasury bond falls into that category. The most recently issued 30-year bond has a 2.75% coupon. The coupon rate determines the interest payments. The 2.75% is the annual coupon ... Government - Continued Treasury Zero Coupon Spot Rates* - Savings Bonds SLGS Rates; IRS Tax Credit Bonds Rates; Treasury's Certified Interest Rates. Federal Credit Similar Maturity Rates. Prompt Payment Act Interest Rate. ... Continued Treasury Zero Coupon Spot Rates* Treasury Spot Rates, Office of Thrift Supervision (OTS) Method; End of Quarter, Percent; Maturity 2012 2013; Years Months I II III IV I II; 0.5: 6: 0.15: Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

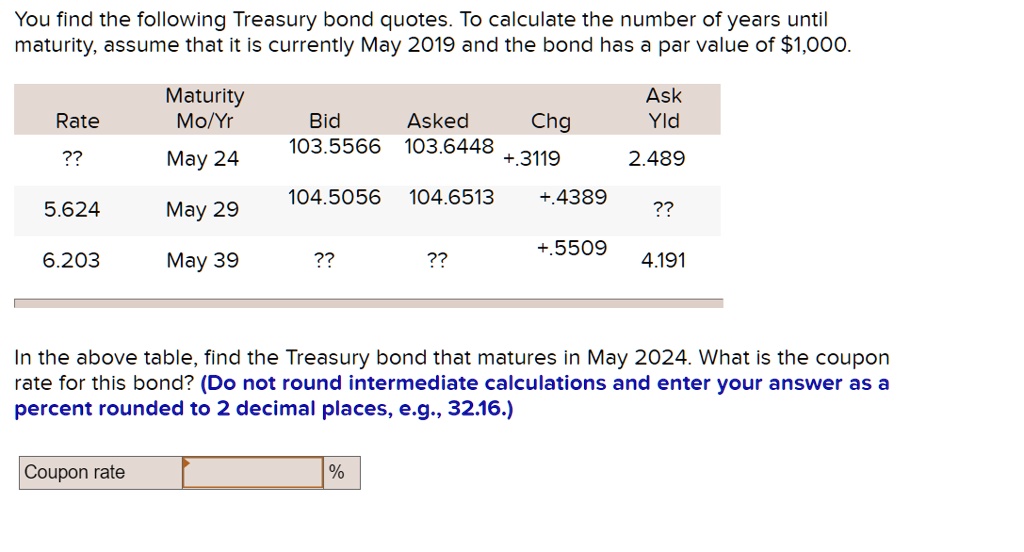

What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%.

US Treasury Zero-Coupon Yield Curve - Nasdaq Refreshed 15 hours ago, on 25 Oct 2022 ; Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding convention. Values are daily estimates of the yield curve from 1961 for the entire maturity range spanned by outstanding Treasury securities.

Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Who sets the coupon rate for treasury bonds? : r/bonds - reddit The Federal Reserve sets the coupon rate as the fiscal agent for the Treasury. But there's really no "setting." Whatever is the winning yield at auction, they raise it to the next highest 8th and that becomes the coupon. So if the winning yield is 2.10, the coupon would become 2.125. 2.

Why are there different coupon rates of treasury bonds on the ... - Quora Yes, most conventional Treasury bonds are issued with a coupon that is fixed for the life of the bond. For example, a 3% coupon bond will pay $15 in interest every 6 months—$30 per year on a bond with $1000 face value— no matter what. But there are exceptions: Bonds that mature in a year or less (called Treasury "Bills").

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

I bonds — TreasuryDirect 9.62% For savings bonds issued May 1, 2022 to October 31, 2022. Complete the purchase of this bond in TreasuryDirect by October 28, 2022 to ensure issuance by October 31, 2022. I bonds at a Glance How do I ... for a Series I savings bond Buy EE or I savings bonds Cash in (redeem) an EE or I savings bond

Important Differences Between Coupon and Yield to Maturity - The Balance For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can expect to receive 2% per year for the life of the bond, or $20 for every $1000 they invested. However, many bonds trade in the open market after they're issued.

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to...

Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

I bonds interest rates — TreasuryDirect Series I Savings Bonds 9.62% For savings bonds issued May 1, 2022 to October 31, 2022. Complete the purchase of this bond in TreasuryDirect by October 28, 2022 to ensure issuance by October 31, 2022. Fixed rate You know the fixed rate of interest that you will get for your bond when you buy the bond. The fixed rate never changes.

Treasury Coupon Bonds - Economy Watch The most important advantage of treasury coupon bonds is that they let you create a stable source of income during a given year. The coupon rate can vary depending upon the structure of the bonds. Some negotiable bond types come with fixed interest rates while others come with variable coupon rates based on the floating interest rate. [br]

U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate - Forbes With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is an ...

Coupon (finance) - Wikipedia Zero-coupon bonds are those that pay no coupons and thus have a coupon rate of 0%. Such bonds make only one payment: the payment of the face value on the maturity date. Normally, to compensate the bondholder for the time value of money, the price of a zero-coupon bond will always be less than its face value on any date

Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The...

Post a Comment for "42 coupon rate for treasury bonds"