39 coupon rate and yield to maturity

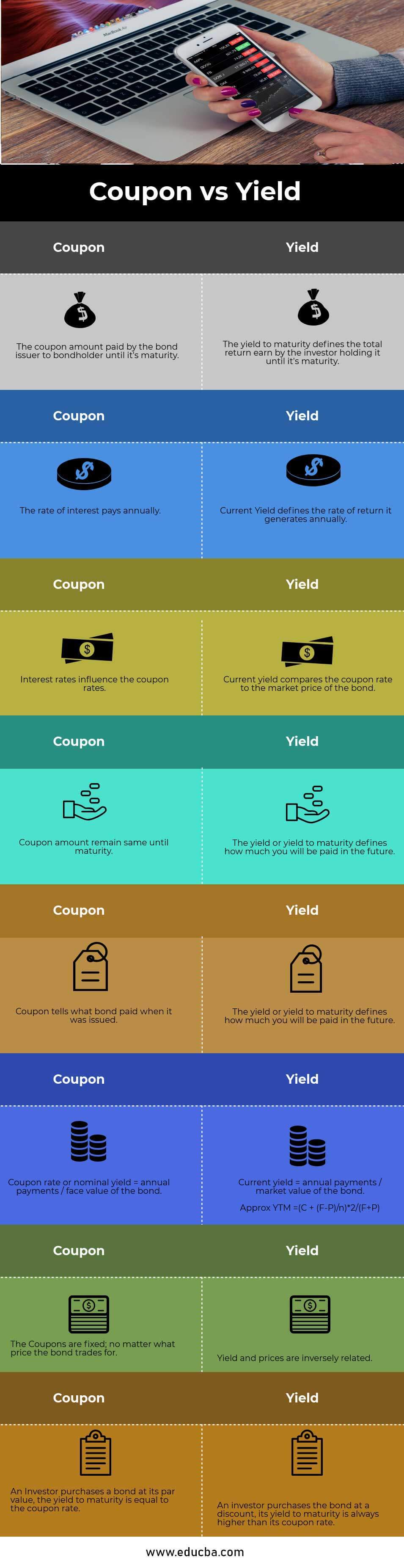

Yield to Maturity and Coupon Rate, The Difference - Financial Digits This will lead to an increase in the yield to maturity. Coupon rate vs. Yield to Maturity. The yield to maturity is equal to the coupon rate when an investor buys the bond at its original price. Hence, if you want to buy a new bond and if you plan to hold it until maturity, it is important to consider the coupon rate. Yield to Maturity vs Coupon Rate: What's the Difference What Is the Coupon Rate? A bond's coupon rate is the fixed percentage of interest you will earn on an annual or semi-annual basis once you purchase it up until the maturity date (the date the bond issuer agrees to repay its investor by when it is purchased). For example, if you take out a $1,000 bond with a coupon rate of 4% and it has an ...

Answered: What is the coupon rate for a bond with… | bartleby Thatcher Corporations bonds will mature in 10 years. The bonds have a face value of 1,000 and an 8% coupon rate, paid semiannually. The price of the bonds is 1,100. The bonds are callable in 5 years at a call price of 1,050. What is their yield to maturity? What is their yield to call?

Coupon rate and yield to maturity

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Yield to Maturity Many people get confused between coupon rate and yield to maturity. In reality, both are very different measures of returns. As discussed, a coupon rate is a fairly straightforward rate that measures the percentage of interest rate that an investor will receive periodically from the bond issuer. Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube In this lesson, we explain the coupon rate, current yield, and yield to maturity (YTM). We go through the coupon rate formula, current yield formula, and the... 25) What is the yield to maturity of a nine -year, | Chegg.com What was the real interest rate in 1975? How would the purchasing power of your savings; Question: 25) What is the yield to maturity of a nine -year, $5,000 bond with a 5.5 % coupon rate and semiannual coupons if this bond is currently trading for a price of $4,720 ? 34) In 1975, interest rates were 7.85% and the rate of inflation was 12.3% in ...

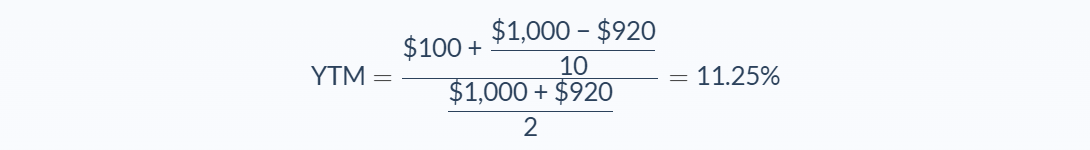

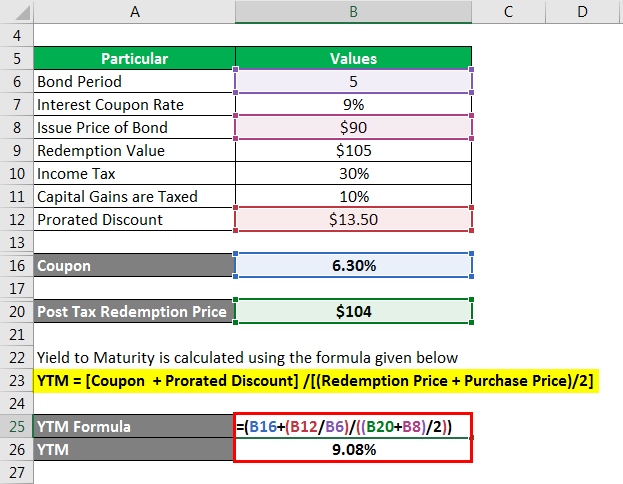

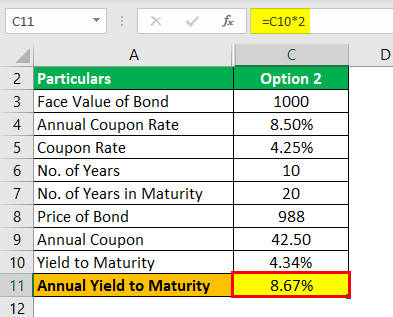

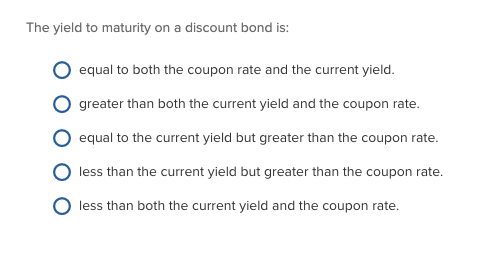

Coupon rate and yield to maturity. Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return of a bond, assuming that it is... Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Difference between Coupon Rate And Yield To Maturity The yield to maturity (YTM) is the rate of return that an investor earns when he holds the bond till the maturity date. The YTM becomes relevant only when an investor buys a bond from the secondary market. To calculate the yield to maturity of a bond, the following formula is used. YTM = { (annual interest payment) + [ (face value - current ...

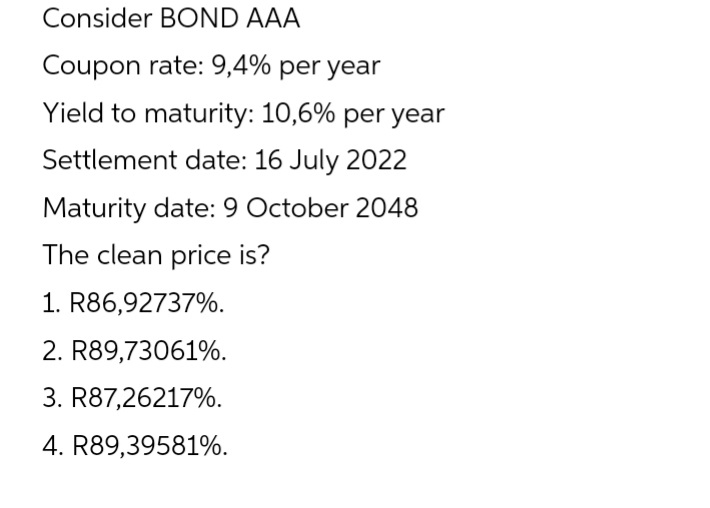

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. Is coupon rate the same as yield to maturity? Yield to maturity is the discount rate at which the sum of all future cash flows from the bond (coupons and principal) is equal to the current price of the bond. The YTM is often given in terms of Annual Percentage Rate (A.P.R.), but more often market convention is followed. Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia To understand the full measure of a rate of return on a bond, check its yield to maturity. Yield Rate A bond's yield can be measured in a few different ways. The current yield... Yield to Maturity (YTM): Formula and Bond Calculation - Wall Street Prep What is Yield to Maturity? The Yield to Maturity (YTM) represents the expected annual rate of return earned on a bond under the assumption that the debt security is held until maturity. From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on time and are then ...

What Is the Difference Between Coupon Rate and Yield-To-Maturity ... Coupon rate is expressed as the percentage (per annum basis) of the face value of the bond. It is the amount that the bondholders will receive for holding the bond. Coupon payments are usually made semi-annually or quarterly. Yield-to-maturity (YTM), as the name states, is the rate of return that the investor/bondholder will receive, assuming ... Yield to Maturity - YTM vs. Spot Rate. What's the Difference? A bond's yield to maturity is based on the interest rate the investor would earn from reinvesting every coupon payment. The coupons would be reinvested at an average interest rate until the bond ... Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity is what the investor can expect to earn from the bond if they hold it until maturity. Do the Math Prices and yields move in opposite directions. A little math can help you further understand this concept. Let's stick with the example from above. The yield increases from 2% to 4%, which means that the bond's price must fall. Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The rate of interest on this bond is set at 20% per annum. Here, the 10% per annum is called the coupon rate. So, when investing Rs. 20,000 in the bond, they will receive Rs. 4,000 per annum as interest payments. Yield to Maturity The yield to maturity is the return rate that investors hold while holding the bond until maturity.

Difference Between Coupon Rate and Yield to Maturity The coupon rate remains the same throughout the bond tenure year, while Yield to Maturity (YTM) changes with the period left for the bond maturation and also on the current market value of the bond. The coupon rate represents the interest payment rates that are to be received annually by the bond receiver.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity is the estimated annual rate of return for a bond assuming that the investor holds the asset until its maturity date and reinvests the payments at the same rate. 1...

If its yield to maturity is less than its coupon rate 74. If its yield to maturity is less than its coupon rate, a bond will sell at a ____, and increasesin market interest rates will ____. A. discount; increase this discount B. discount; decrease this discountC. premium; increase this premium D. premium; decrease this premium E. None of the above. 5-19.

What is the difference between Coupon Rate and Yield to Maturity ... The rate at which a bond's investor receives interest payments is known as the coupon rate. It is a percentage that represents the annual interest rate that the bond pays in relation to its face value. The coupon rate is comparable to fixed-income government and corporate bonds, in which the bond's issuer receives yearly interest payments.

Difference Between Yield to Maturity and Coupon Rate The coupon rate is 5.25% with a term to maturity of 4.5 years. Yield to Maturity is calculated as, Yield to Maturity = 5.25 + (100-102.50/4.5) / (100+102.50/2) = 4.63% Yield to Maturity can be identified as an important yardstick for an investor to understand the amount of return a bond will generate at the end of the maturity period.

25) What is the yield to maturity of a nine -year, | Chegg.com What was the real interest rate in 1975? How would the purchasing power of your savings; Question: 25) What is the yield to maturity of a nine -year, $5,000 bond with a 5.5 % coupon rate and semiannual coupons if this bond is currently trading for a price of $4,720 ? 34) In 1975, interest rates were 7.85% and the rate of inflation was 12.3% in ...

Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube In this lesson, we explain the coupon rate, current yield, and yield to maturity (YTM). We go through the coupon rate formula, current yield formula, and the...

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Yield to Maturity Many people get confused between coupon rate and yield to maturity. In reality, both are very different measures of returns. As discussed, a coupon rate is a fairly straightforward rate that measures the percentage of interest rate that an investor will receive periodically from the bond issuer.

:max_bytes(150000):strip_icc()/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Post a Comment for "39 coupon rate and yield to maturity"