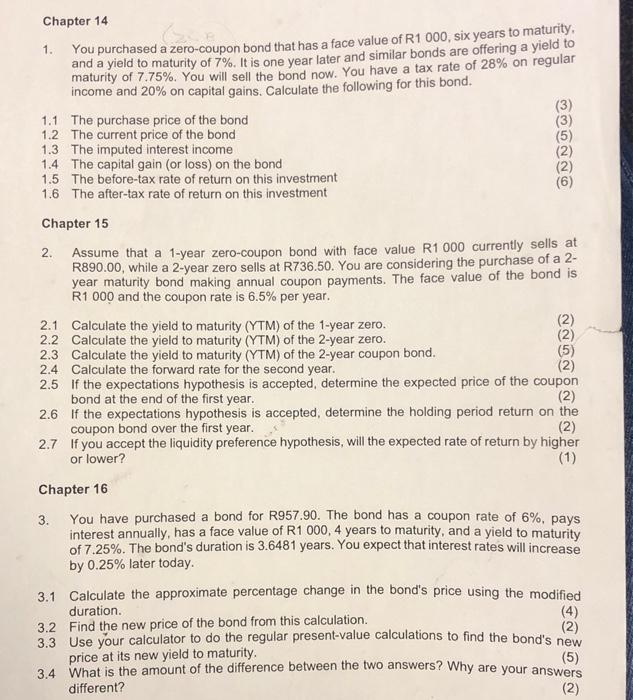

41 present value of zero coupon bond calculator

How to Calculate Yield to Maturity of a Zero-Coupon Bond Instead, z-bonds are issued at a discount and mature to their face value. As a result, YTM calculations for zero-coupon bonds differ from traditional bonds. Calculate Zero-coupon Bond Purchase Price Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power ...

Zero Coupon Bond Value Calculator - StableBread Present Value and Future Value. Discounted Payback Period (DPP) Calculator · Future Value (FV) Calculator · Future Value Factor (FVF) Calculator ...

Present value of zero coupon bond calculator

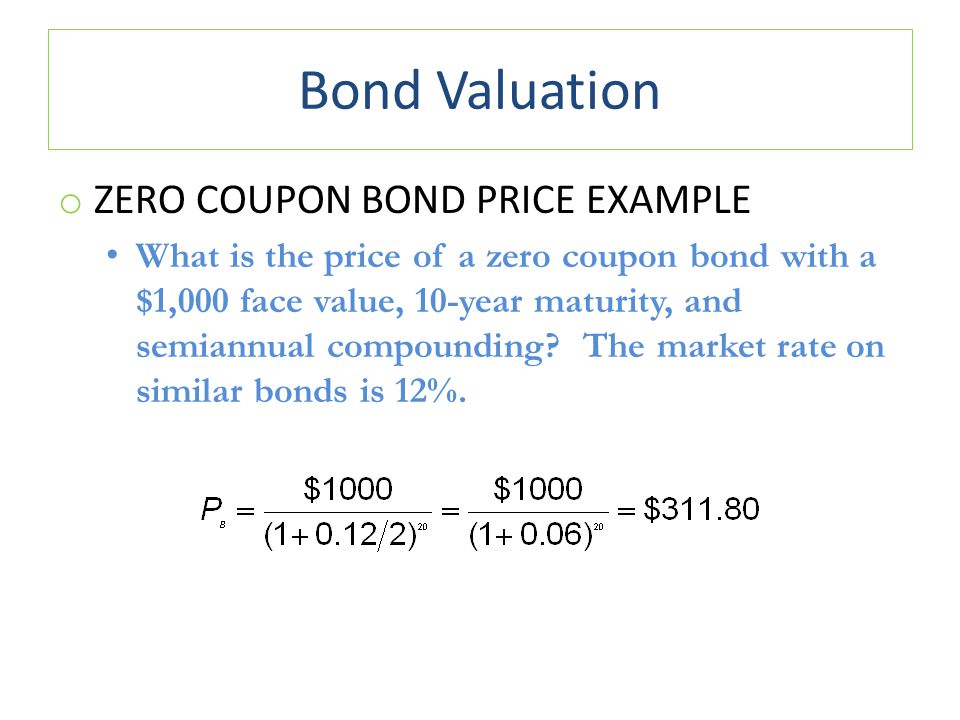

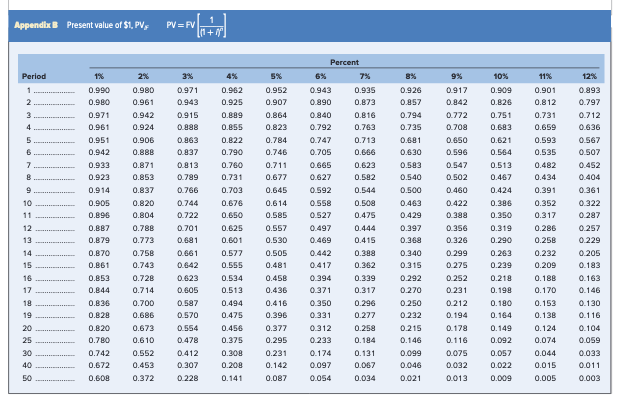

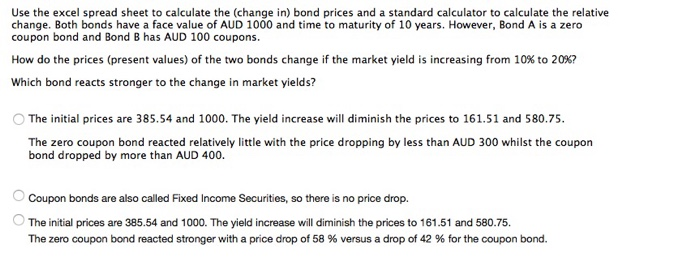

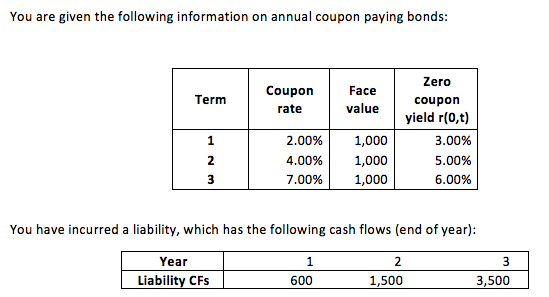

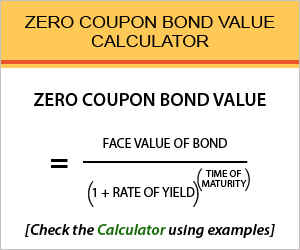

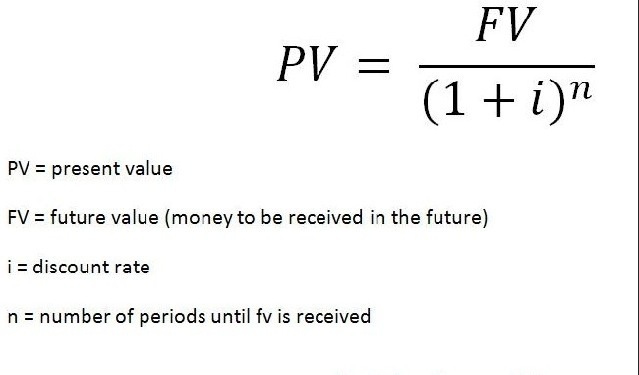

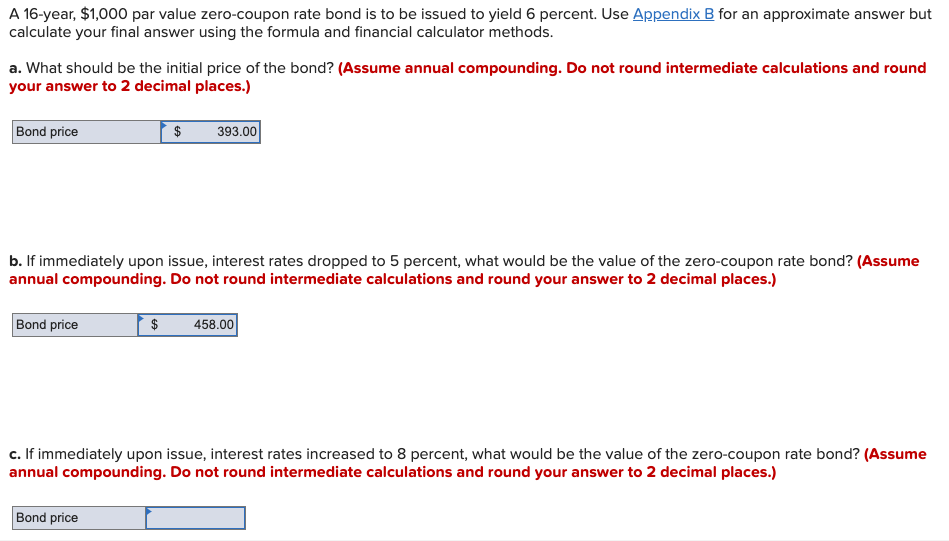

Zero Coupon Bond Calculator – What is the Market Value? - DQYDJ A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). Zero Coupon Bond Value Calculator - BuyUpside.com The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield ... Bond valuation (Zero coupon bonds) |Calculator - Trignosource Zero-coupon bond pricing refers to finding out the fair value of a zero-coupon bond, which is simply the present value of the redemption amount of that bond ...

Present value of zero coupon bond calculator. Zero-Coupon Bonds: Characteristics and Calculation Example Zero-Coupon Bond ; Formula · PV = Present Value; FV = Future Value; r = Yield-to-Maturity (YTM) ; Model Assumptions. Face Value (FV) = $1,000; Number of Years to ... Zero Coupon Bond Calculator - MiniWebtool When the bond reaches maturity, its investor receives its face value. It is also called a discount bond or deep discount bond. Formula. The zero-coupon bond ... Zero Coupon Bond Value - Financial Formulas (with Calculators) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. Zero Coupon Bond - Explained - The Business Professor, LLC Apr 17, 2022 ... Below is the formula for calculating the present value of a zero coupon bond: Price = M / (1 + r)^n where M = the date of maturity r ...

Bond valuation (Zero coupon bonds) |Calculator - Trignosource Zero-coupon bond pricing refers to finding out the fair value of a zero-coupon bond, which is simply the present value of the redemption amount of that bond ... Zero Coupon Bond Value Calculator - BuyUpside.com The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield ... Zero Coupon Bond Calculator – What is the Market Value? - DQYDJ A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value).

Post a Comment for "41 present value of zero coupon bond calculator"