42 coupon interest rate definition

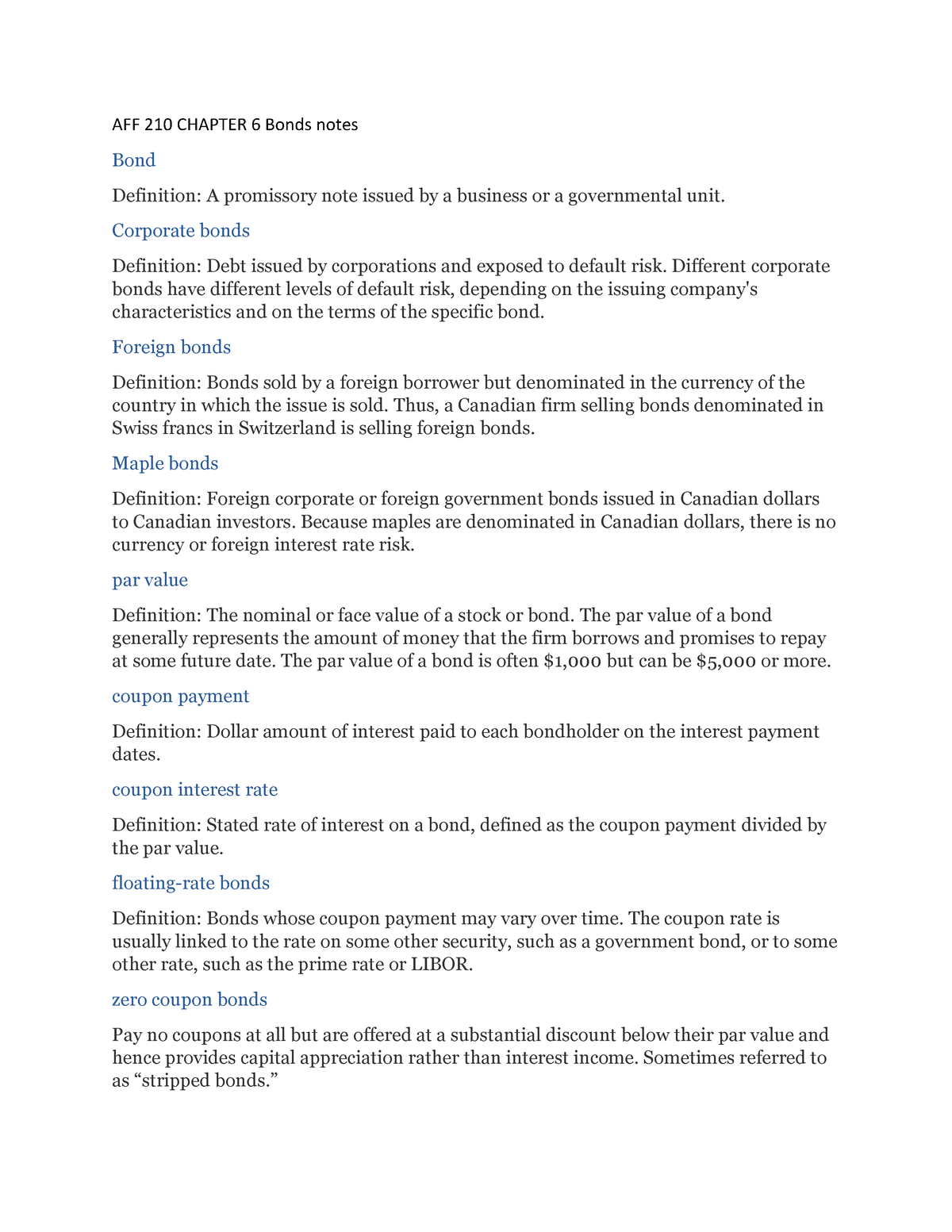

Interest Rate Statistics | U.S. Department of the Treasury WebNOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market … Bond: Financial Meaning With Examples and How They Are Priced WebJul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

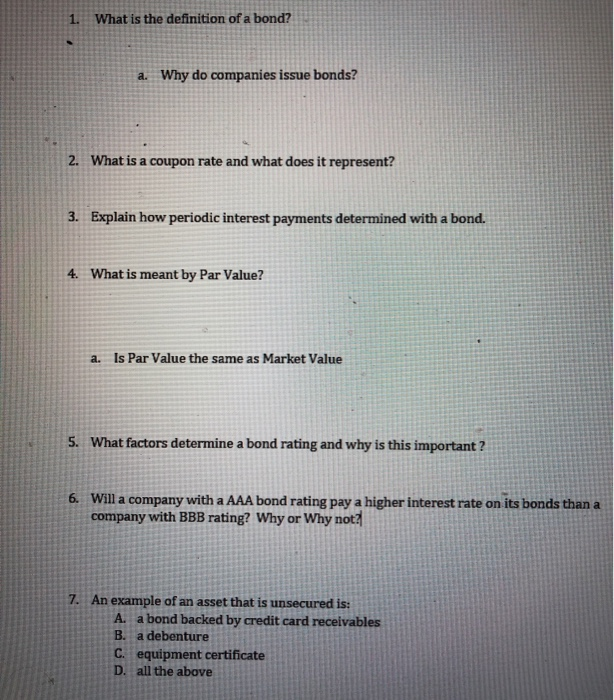

How to Calculate an Interest Payment on a Bond: 8 Steps - wikiHow WebDec 10, 2021 · Find the bond's "coupon" (interest) rate at the time it was issued. The rate is stated in the bond's paperwork. It may also be called the face, nominal or contractual interest rate. The coupon rate established when the bond was issued remains unchanged and is used to determine interest payments until the bond reaches maturity.

Coupon interest rate definition

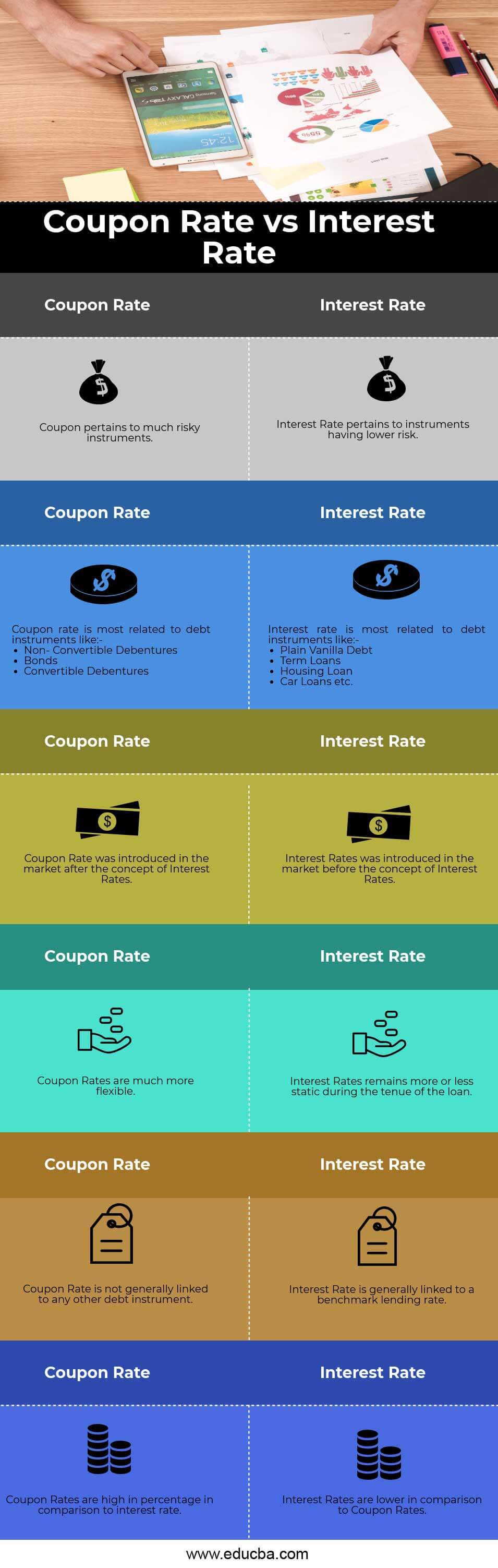

Interest Rate Swaps Explained – Definition & Example - Money Crashers WebSep 14, 2021 · Interest rate swaps are traded over the counter, and if your company decides to exchange interest rates, you and the other party will need to agree on two main issues: Length of the swap . Establish a start date and a maturity date for the swap, and know that both parties will be bound to all of the terms of the agreement until the contract ... Interest - Wikipedia WebIn finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct from a fee which the borrower may pay the lender or some third party. It is also distinct from dividend which is paid by a … Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo WebAlso, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ...

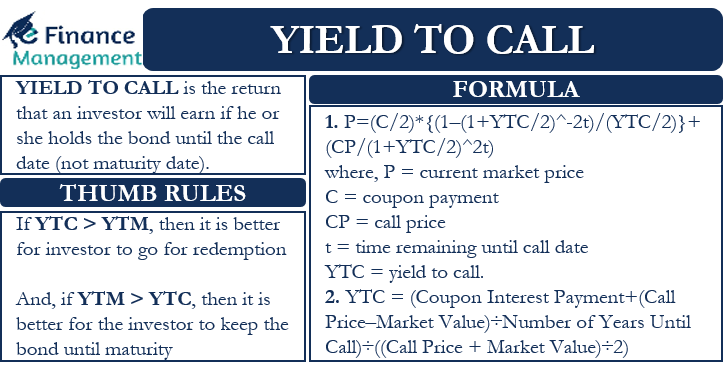

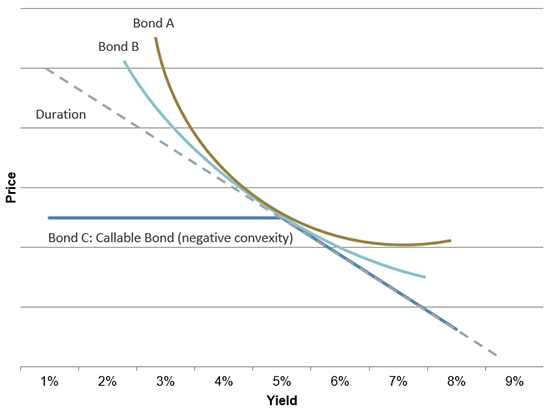

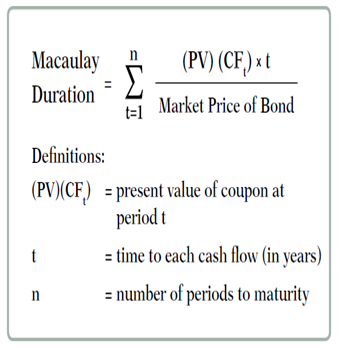

Coupon interest rate definition. What Is a Bond Coupon, and How Is It Calculated? - Investopedia WebApr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. Interest rate - Wikipedia WebAn interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum).The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. Coupon Rate Definition - Investopedia WebMay 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Yield to Maturity (YTM): What It Is, Why It Matters, Formula - Investopedia WebMay 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo WebAlso, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ... Interest - Wikipedia WebIn finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct from a fee which the borrower may pay the lender or some third party. It is also distinct from dividend which is paid by a … Interest Rate Swaps Explained – Definition & Example - Money Crashers WebSep 14, 2021 · Interest rate swaps are traded over the counter, and if your company decides to exchange interest rates, you and the other party will need to agree on two main issues: Length of the swap . Establish a start date and a maturity date for the swap, and know that both parties will be bound to all of the terms of the agreement until the contract ...

Post a Comment for "42 coupon interest rate definition"